Article

(3 mins)

_____________________________________________________________________________________________________________________________

Mom used to say I needed to eat the broccoli, not just the chicken and mash. With a loathsome look toward the rubbery, toad-green tree on my plate, she would follow with “it’s part of a balanced diet.” Not ready to accept my fate, I sought aid from my brothers. “It’ll put hair on your chest,” they said. I gave in and ate the vegetable. Its horrible taste lingered on my tongue as I pondered why my brothers’ bizarre comment motivated my surrender. Alas, it wasn’t my brothers. It was mom, whom I trusted implicitly, and her words. One word. Balance.

We all seek balance, and by extension, completeness. It’s not enough to have a portion of our needs met, we must have a comprehensive solution. The same concept applies to currency risk management. Entities may take thoughtful, pragmatic steps to reduce their currency risk exposure by hedging. They may have robust framework with good governance, sound policies and procedures, and capable resources to implement the hedge program, but they often fall short in one area: accounting.

Who loves balance more than accountants? Think about it: debits equal credits; assets equal liabilities plus equity; bank accounts reconciled to the penny. It’s beautiful. Bringing this back to the point, hedging causes problems because it creates volatility in earnings. The irony is palpable, is it not?

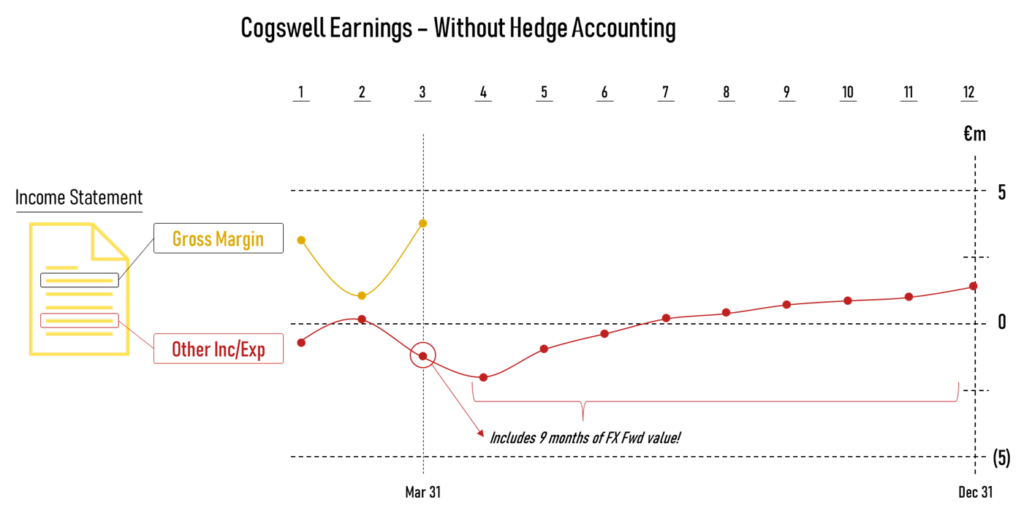

Hedging instruments are derivatives, and derivatives must be marked-to-market. The mark-to-market remeasurement is based on currencies and interest rates. Currencies and interest rates change daily, so too does the mark-to-market. The changes in mark-to-market valuation must be recorded immediately in earnings, typically in a non-operating income or expense line item. Therefore, the fundamental reason for hedging in the first place – reducing exposure to volatility in currency fluctuations – is undermined by the accounting impact when using hedging instruments. In a sense, entities using derivatives are exchanging one source of volatility for another. Hedge accounting is the elixir for this malady.

Hedge accounting is the informal term for derivative accounting guidance included in International Financial Reporting Standards number 9 (“IFRS 9”). Among other things, it is a preferential accounting treatment that allows entities to reduce the volatility in earnings caused by derivatives.

How does it work? Consider two principal financial components of derivative use: a) changes in mark-to-market (stated above), and b) cash flow settlements. In an ideal world, these two components offset perfectly in earnings against the risk being hedged, both in terms of timing and amount. But the world is not perfect. It is cruel and unyielding (e.g., ‘broccoli’). Absent hedge accounting, the derivative and currency exposure are misaligned, impacting earnings at different points in time, which in turn causes volatility.

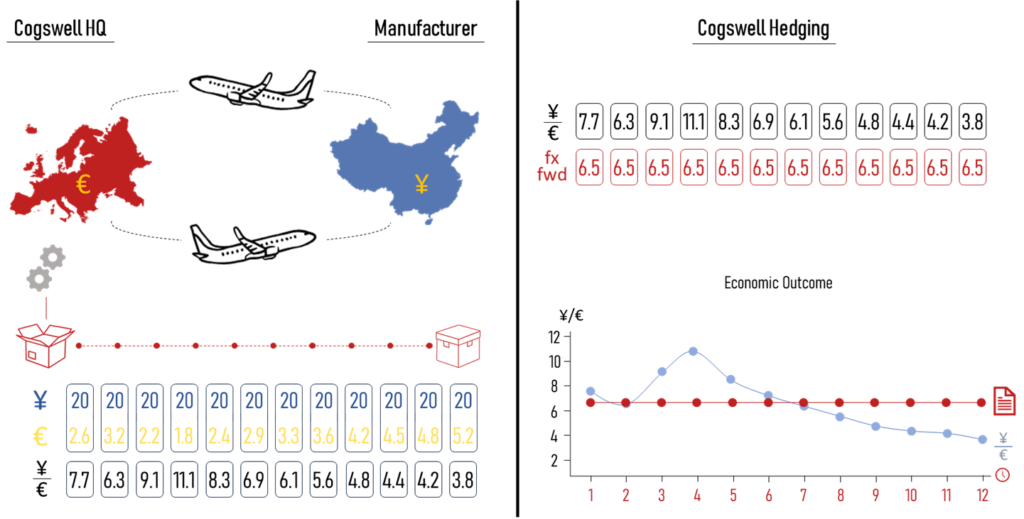

Let’s work through an example. Cogswell Ltd., a EUR-based reporting entity, manufactures a ground-breaking product called cogs. To make the cogs, it sources sprockets from China for ¥20M per month. Currently, EUR/CNY rate is 7.69, meaning Cogswell’s monthly payment is about €2.6M. With budget season afoot, Cogswell is concerned by the future variability in EUR/CNY FX rate and decides to hedge its risk exposure using a strip of monthly FX forwards. The FX forwards effectively lock-in Cogswell’s EUR/CNY FX rate for the coming year by allowing it to sell EUR and buy CNY at fixed exchange rates in the future.

Fast forward to Cogswell’s March 31 reporting date. We see in the chart that the periodic changes in value of its FX forwards can wreak havoc on Cogswell’s earnings. Why? Although Cogswell was able to fix the floating FX rate, the total value of FX forward positions hedging future months – namely, April through December – continues to be recorded in earnings. This happens without hedge accounting, an unfavorable outcome.

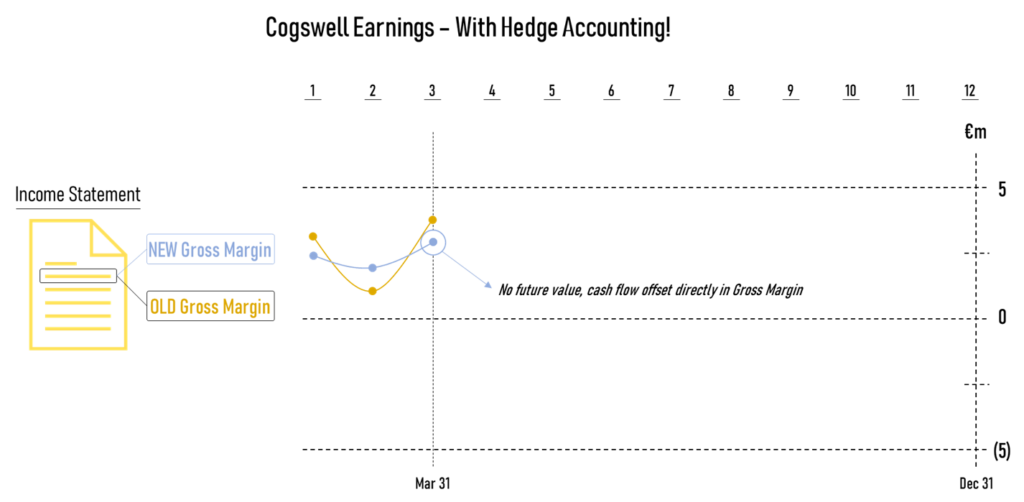

If Cogswell adopts hedge accounting, those future FX forward positions can be removed from earnings. Instead of living in earnings, the change in FX forwards’ value can be deferred on the balance sheet in an equity account called Other Comprehensive Income. As expected, removing the value remeasurement from earnings reduces volatility.

Hedging and hedge accounting are complicated. Initiating and maintaining a hedging program takes time, discipline, and resources. But the benefits can be significant. “It’s not for me” you say. Well, if you run a company that has exposure to foreign currencies and if you care about operating margin, then think again. Hedge accounting compliance conveys to creditors and key stakeholders that an entity is a good steward of capital. Sure, it may not be easy to digest, but it’s good for you. So, listen to your mom, and eat your broccoli.